Which of the following best describes how a corporation, which has not made any special tax

elections, and its shareholders, are taxed?

A) The corporation is taxed, and the shareholders are taxed on their dividends.

B) The corporation is taxed, but the shareholders are not taxed on their dividends.

C) The corporation is not taxed, but the shareholders are taxed on their dividends.

D) Neither the corporation nor its shareholders are taxed.

E) They are taxed as a partnership is taxed.

A

You might also like to view...

The SEC and PCAOB independence rules for auditors are identical

a. True b. False Indicate whether the statement is true or false

What type of experimental validity is concerned with the extent that the relationship observed between the independent and dependent variable during the experiment IS generalizable to the real world?

A) internal validity B) external validity C) extraneous validity D) causal validity E) face validity

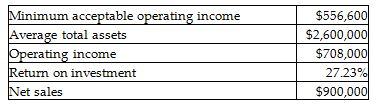

Barrera Corporation provides the following financial information:

Calculate the target rate of return. (Round your answer to two decimal places.)

A) 21.41%

B) 78.67%

C) 27.23%

D) 61.84%

Discuss the ramifications of firing employees from their job by email or text message

What will be an ideal response?