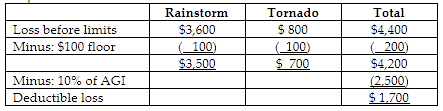

Hope sustained a $3,600 casualty loss due to a severe rainstorms classified as a federal disaster. She also incurred a $800 loss from a tornado also classified as a federal disaster in the same year. Both losses involved personal-use property. Hope's AGI for the year is $25,000 and she does not have insurance coverage. Hope's deductible casualty loss is

A) $1,700.

B) $1,800.

C) $4,200.

D) $4,300.

A) $1,700.

You might also like to view...

Which of the following is an example of a wasting asset?

a. timber b. land c. equipment d. building

Which of the following is an example of time utility?

A. a dry cleaners that is located inside a supermarket B. Goodwill that has a 24-hour drop off box for clothing donations C. an iPhone with a "multitouch" user interface for easy navigation D. a mobile phone company that offers six-month financing, same as cash E. a new herbal supplement that offers a 30-day free trial

Which of the following is not considered in computing net cost of purchases?

a. Freight-out expenses b. Purchases c. Freight paid on purchased goods d. Purchases returns and allowances

Which of the following statements about job-order cost sheets is true?

a. All job-order cost sheets serve as the general ledger control account for Work in Process Inventory. b. Job-order cost sheets can serve as subsidiary ledger information for both Work in Process Inventory and Finished Goods Inventory. c. If material requisition forms are used, job-order cost sheets do not need to be maintained. d. Job-order cost sheets show costs for direct material and direct labor, but not for manufacturing overhead since it is an applied amount.