A 10-cent-per-box tax on producers of cigars will

a. shift the firm's ATC and MC curves upward by the full amount of the tax.

b. induce the firm to produce less but will not shift the firm's MC curve.

c. shift the firm's ATC and MC curves downward by the full amount of the tax.

d. shift the MC curve upward but will not cause any shift in the ATC curve.

A

You might also like to view...

An increase in the price of oil ________ aggregate supply, shifting the aggregate supply curve ________ and potentially bringing the ________ phase of the business cycle

A) decreases; rightward; expansion B) increases; rightward; recession C) increases; rightward; expansion D) decreases; leftward; recession E) decreases; rightward; recession

Which of the following statements is FALSE?

A) Comparative advantage is the principle upon which trade patterns are based. B) Opportunity cost measures the real cost to a country of producing a certain product. C) The gains from trade are the result of differences in opportunity cost and comparative advantage. D) A country that possesses an absolute advantage will always have a comparative advantage. E) Comparative advantage is necessary and sufficient for trade.

“Assuming the long-run average cost curve is U shaped, a firm will always seek to operate at the lowest point on the long-run average cost curve.” True or false?

What will be an ideal response?

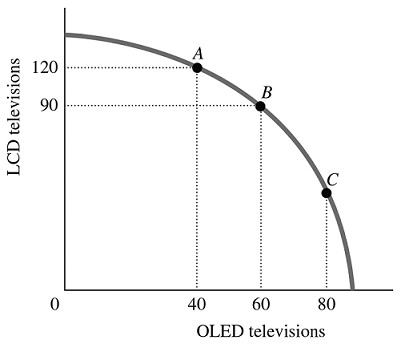

Refer to the information provided in Figure 2.5 below to answer the question(s) that follow. Figure 2.5Refer to Figure 2.5. For this economy to move from Point C to Point B, ________ additional LCD TVs could be produced when the production of OLED TVs is reduced by 20.

Figure 2.5Refer to Figure 2.5. For this economy to move from Point C to Point B, ________ additional LCD TVs could be produced when the production of OLED TVs is reduced by 20.

A. exactly 30 B. exactly 60 C. fewer than 30 D. more than 30