The welfare program economists believe to be most compatible with economic efficiency is

A. a regressive tax system.

B. AFDC.

C. a negative income tax.

D. Medicare/Medicaid.

Answer: C

You might also like to view...

When the price of a good or service changes,

a. the demand curve shifts in the opposite direction. b. the supply curve shifts in the opposite direction. c. the supply curve shifts in the same direction. d. there is a movement along a given supply curve.

How do prices provide incentives in a competitive market?

a. Higher prices cause buyers to purchase less of a good or service. b. Higher prices cause producers to make less of a good or service. c. Lower prices result in buyers and sellers dropping out of the market. d. Lower prices inspire buyers and sellers to become entrepreneurs.

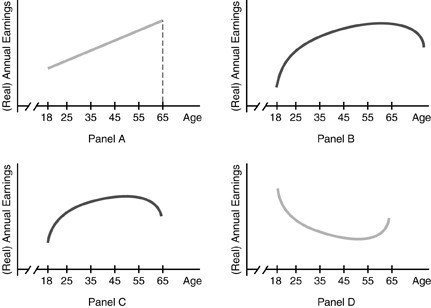

Refer to the above figure. Which of the graphs are consistent with the age-earnings profile?

Refer to the above figure. Which of the graphs are consistent with the age-earnings profile?

A. Panel A B. Panel B C. Panel C D. Panel D

It has been proposed that a government agency be charged with the responsibility for determining the amount of pollution which the atmosphere or a body of water can safely recycle, and sell these limited rights to polluters. What would be the advantage of such a market for pollution rights?

What will be an ideal response?