A monopolist faces the inverse demand curve P = 60 - Q. It has variable costs of Q2 so that its marginal costs are 2Q, and it has fixed costs of 30

If a governmental agency imposes an $8 per unit specific tax on output, the deadweight loss from both the monopoly and the tax is A) $37.50.

B) $73.00

C) $526.50.

D) $562.50.

B

You might also like to view...

Using the data in the above table, what is the average product of three employees?

A) 2 pizzas per hour B) 3 pizzas per hour C) 4 pizzas per hour D) 12 pizzas per hour

Given the equations for C, I, G, and NX below, what is the equilibrium level of GDP?

C = 1,000 + 0.8Y I = 1,500 G =1,250 NX = 100 A) $3,080 B) $3,850 C) $6,930 D) $19,250

What is the marginal cost of the 5th unit?

a. $100 b. $105 c. $110 d. $115

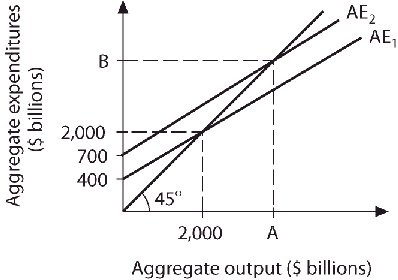

Refer to the information provided in Figure 24.4 below to answer the question(s) that follow. Figure 24.4Refer to Figure 24.4. Along aggregate expenditure AE1, the MPS will be

Figure 24.4Refer to Figure 24.4. Along aggregate expenditure AE1, the MPS will be

A. 0.4. B. 0.3. C. 0.2. D. 0.1.