A retired woman has $130,000 to invest. She has chosen one relatively safe investment fund that has an annual yield of 9% and another, riskier one that has an annual yield of 13%. How much should she invest in the fund yielding 9% if she would like to earn $14,000 per year from her investments?

?

A. $11,700

B. $16,900

C. $57,500

D. $72,500

E. $113,100

Answer: D

You might also like to view...

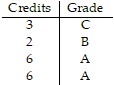

Find the grade point average for the following student. Assume A = 4, B = 3, C = 2, D = 1, and F = 0. Round answer to the nearest tenth.

A. 3.5 B. 4.0 C. 2.4 D. 11.0

Solve the problem. Round to two decimal places unless otherwise indicated.Suppose the cost per ton, y, to build an oil platform of x thousand tons is approximated by y =  . What is the cost per ton for x = 400?

. What is the cost per ton for x = 400?

A. $113,513.51 B. $200,000.00 C. $131.25 D. $283.78

Use a graphing calculator to solve the system. Express solutions with approximations to the nearest thousandth.  x + y = 50.4x - y = 3

x + y = 50.4x - y = 3

A. {(-2.947, 8.789)} B. ? C. {(4.746, -1.102)} D. {(2.258, 2.097)}

Simplify.10 + (-71) - 40 - (-59) + (-31)

A. -73 B. -191 C. -129 D. -11