Disclaimers of opinion can only be issued by auditors based on which of the following?

a. Violations of GAAP.

b. Substantial scope limitations.

c. Going concern.

d. Lack of independence.

e. Either B or D.

e

You might also like to view...

________ means being available at any location at any time

Fill in the blank(s) with correct word

The Sweet Smell of Success Fragrance Company borrowed $60,000 from the bank to be paid back in five years and used all of the money to purchase land for a new store. Sweet Smell's balance sheet would show this as:

A. $60,000 under Land and $60,000 under Notes Receivable (long-term). B. $60,000 under Other Assets and $60,000 under Other Liabilities. C. $60,000 under Land and $60,000 under Notes Payable (long-term). D. $60,000 under Depreciation Expense and $60,000 under Notes Payable (long-term).

Once you have made all the arrangements for any meeting, your job is done

Indicate whether the statement is true or false.

For Proposal 2, the tax effect on the sale of the existing asset at the end of the fifth year results in ________. (See Table 11.2)

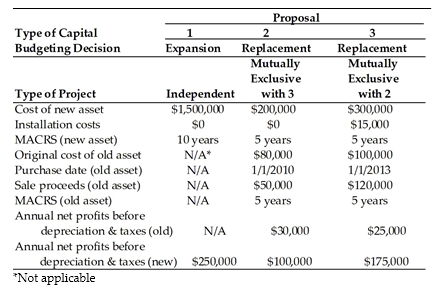

Table 11.2

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2019. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. New assets will be depreciated under the MACRS system rather than being fully expensed right away. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

A) $12,000 tax liability

B) $14,560 tax liability

C) $25,280 tax liability

D) $16,600 tax liability