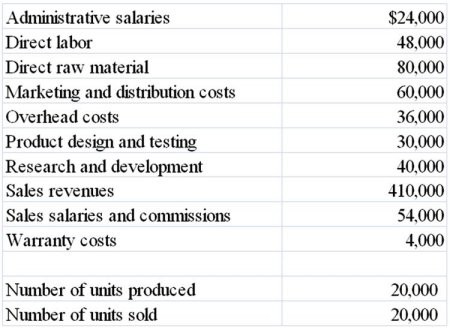

Arizona Company provided the following information regarding its most recent year of operations: Required:Determine the following amounts:(a) Total product costs(b) Total upstream costs(c) Total downstream costs(d) Product cost per unit(e) Total cost per unit, including product costs and upstream and downstream costs(f) The selling price per unit that would be required if the company wishes to earn a profit margin equal to 25% of total cost(g) Comment on the company's profitability at its current selling price

Required:Determine the following amounts:(a) Total product costs(b) Total upstream costs(c) Total downstream costs(d) Product cost per unit(e) Total cost per unit, including product costs and upstream and downstream costs(f) The selling price per unit that would be required if the company wishes to earn a profit margin equal to 25% of total cost(g) Comment on the company's profitability at its current selling price

What will be an ideal response?

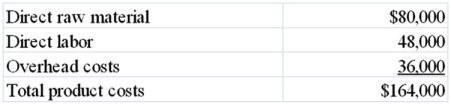

(a) Total product costs:

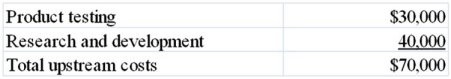

(b) Total upstream costs:

(c) Total downstream costs:

(d) Total product cost per unit:

Total product costs/units produced = $164,000/20,000 = $8.20 per unit

(e) Total cost per unit:

Total costs/units produced = $376,000/20,000 = $18.80 per unit

(f) Selling price to earn a profit margin equal to 25% of total cost:

Total unit cost + (total unit cost times profit margin) = $18.80 + ($18.80 × 25%) = $23.50 per unit

(g) Current profitability:

The company's current selling price of $20.50 ($410,000/20,000 units) covers the product costs and the upstream and downstream costs, but it does not provide the amount of profit that the company would like to earn. Instead of generating a profit margin of 25% of total costs, it is earning a profit margin of approximately 9% of total costs.

You might also like to view...

Sending a thank-you message following an interview is a professional courtesy, but unnecessary if you thank the interviewer before departing from the interview

Indicate whether the statement is true or false

Minimum wages, hours of employment, and child labor are regulated by the:

A) Regulated Hours Act. B) Fair Labor Standards Act. C) Right to Work Laws. D) Federal Employment Act of 1940.

Darren was offered a promotion in exchange for a date with his supervisor. He was upset as he had no interest in dating her, yet he agreed because he really wanted the promotion. This is an example of

A. whistleblowing. B. sugging. C. social loafing. D. quid pro quo harassment. E. performance reciprocity.

The prime rate of interest is

A) the rate the bank charges on home mortgages. B) the rate the bank charges its average borrower. C) the rate the bank charges its most creditworthy borrowers. D) the rate the bank charges for money it borrows from the Federal Reserve Board.