Which of the following are examples of financial assets that pay a long-term interest rate?

A. Money and CDs

B. Saving deposits and checking accounts

C. Cash and currency

D. Mortgages and government bonds

Answer: D

You might also like to view...

Which of the following would not increase French exports to the United States?

a. an appreciation of the U.S. dollar b. an appreciation of the euro c. a depreciation of the euro d. an increase in French preferences for American goods e. an increase in real income in France

The current U.S. income tax system requires taxpayers to pay a higher marginal tax rate on higher levels of taxable income. Suppose that the tax rate is 10 percent on the first $15,000 of taxable income, 15 percent on the next $45,000 of taxable income, 30 percent on the next $60,000 of taxable income, and 35 percent on taxable income above $120,000. Suppose the tax code also includes provisions that allow taxpayers to reduce the income on which they are taxed, and that those provisions most often apply to the richest taxpayers. These provisions tend to make the tax code:

A. more efficient. B. more progressive. C. less progressive. D. less regressive.

Suppose that the maximum price for rent in New York City is set above the equilibrium price. Which of the following statements is incorrect?

A. It reduces the quantity supplied. B. It increases the quantity demanded. C. Consumers want to buy more than producers want to sell. D. All of these are incorrect.

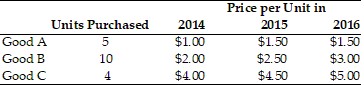

Refer to the information provided in Table 22.6 below to answer the question(s) that follow.

Table 22.6 Refer to Table 22.6. The bundle price for the goods in period 2014 is

Refer to Table 22.6. The bundle price for the goods in period 2014 is

A. $41.00. B. $50.50. C. $57.50. D. $100.00.