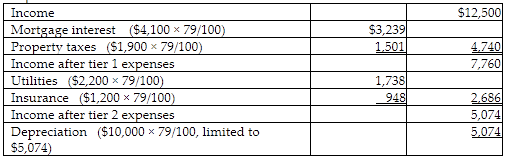

Using the IRS method of allocating expenses, the amount of depreciation that Abby may take with respect to the rental property will be

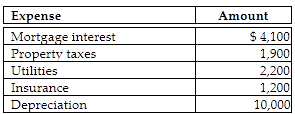

Abby owns a condominium in the Great Smokey Mountains. During the year, Abby uses the condo a total of 21 days. The condo is also rented to tourists for a total of 79 days and generates rental income of $12,500. Abby incurs the following expenses:

A) $5,074.

B) $8,515.

C) $7,900.

D) $10,000.

A) $5,074.

The taxpayer's use exceeds 10% of the rental days so the property is limited by the vacation home rules.

You might also like to view...

Discuss what employers look for during the interview process

What will be an ideal response?

When the net cash inflow is the same every year for a project after the initial investment, the internal rate of return of a project can be determined by dividing the initial investment required in the project by the annual net cash inflow. This computation yields a factor that can be looked up in a table of present values of annuities to find the internal rate of return.

Answer the following statement true (T) or false (F)

Because Austria is located within central western Europe and in the Cold War joined the Western nations, it became a favored location for offices of international firms servicing eastern European operations.

Answer the following statement true (T) or false (F)

When thefirst two steps fail while implementing positive discipline, decision-making leave is provided, which is a paidleave.

Answer the following statement true (T) or false (F)