Ferrous Supplies, Inc., a manufacturer of finished steel products from recycled metals and recycled ferrous and non-ferrous metal and auto parts, is evaluating two mutually exclusive investment projects. In the first project, the firm will supply 8,000 wheels annually to Ford Motor Company at an average price of $750 per wheel over a period of 5 years. The second project involves the supply of 12,000 auto exhaust systems annually to General Motors Company at an average price of $300 per unit over a period of seven years. The equipment required to produce the wheels will cost $2,400,000 plus $100,000 in shipping and installation costs. This equipment has an expected life of 10 years and will be depreciated using the MACRS 7-year class life. After the 5-year contract with Ford Motor

Company, this equipment can be sold for 700,000, but the firm will need to pay $30,000 in removal expenses. The production of the wheels will require an additional investment of $500,000 in raw materials and the variable costs per wheel are estimated to be 70% of the selling price. The forecasted fixed costs associated with the wheels include 12 workers to operate the equipment earning an average of $40,000 each per year in salaries and benefits, $50,000 annually in maintenance costs, and $20,000 in miscellaneous fixed expenses. 1. The equipment required to produce auto exhaust systems will cost $1,500,000 plus $150,000 of shipping and installation expenses. The expected life of this equipment is 10 years and will be depreciated using the MACRS 5-year class life. The equipment has an estimated salvage value of $150,000 after the 7-year contract with General Motors Company, but the firm will need to pay $50,000 in removal expenses. The production of the auto exhaust systems will require an additional investment of $200,000 in raw materials and the variable costs per unit are estimated to be 60% of the selling price. The forecasted fixed costs associated with the systems include 15 workers to operate the equipment earning an average of $38,000 each per year in salaries and benefits, $30,000 annually in maintenance expenses, and $10,000 in miscellaneous fixed expenses. The firm plans to finance the selected investment project with a bank loan at a fixed rate of 7% for 5 or 7 years depending upon the selected project’s life. The workers’ salaries and benefits, and maintenance expenses are expected to grow at an average rate of inflation of 3%. The firm’s WACC is 15%, its reinvestment rate is 10%, and its marginal tax rate is 40%.

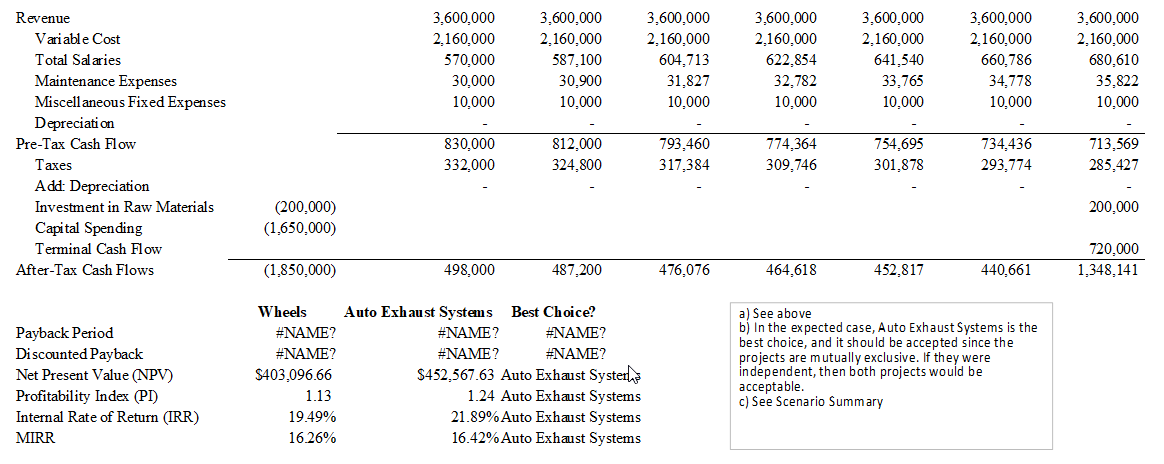

a) Calculate the initial investment, annual after-tax cash flows, and the terminal cash flow of each investment project.

b) Calculate the payback period, discounted payback period, NPV, PI, IRR, and MIRR of each investment project. Should the firm accept or reject one or both projects?

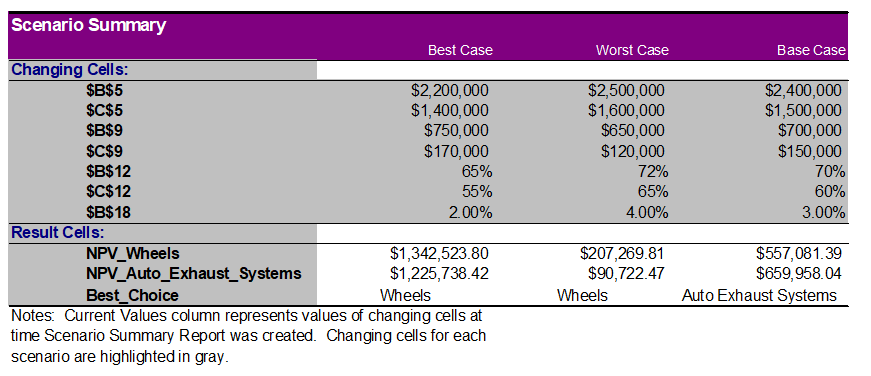

c) The firm’s management has decided to reconsider some estimated variables and has determined the following three possible scenarios:

Create a scenario analysis showing the NPV of each project using the information in the table above. Which project should be selected under which scenario?

You might also like to view...

By selecting a sample of additions to property, plant, and equipment and then examining the related vendor invoices, the auditor is testing which of the following assertions for property, plant, and equipment?

A. Cutoff. B. Completeness. C. Occurrence. D. Classification.

In statistical experiments, each time the experiment is repeated

A. the same outcome must occur. B. the same outcome can not occur again. C. a different outcome might occur. D. a different out come must occur.

Members of management can increase trust in their organizations by ________

A) involving employees in the process by asking for their ideas and opinions B) demonstrating what a great workplace they have C) covering up any negative comments about an employee's performance D) advocating for employees who stand firmly behind management

Operating activities are transactions and events associated with selling a product or providing a service

Indicate whether the statement is true or false