Suppose Sam's Shoe Co. makes only one kind of shoe, which sells for $50 a pair. If they sold 500,000 pairs of shoes, and had a total cost of $1,000,000, what was the company's profit?

A. $40,000,000

B. $24,000,000

C. $1,500,000

D. Not enough information is given to calculate profit.

Answer: B

You might also like to view...

Suppose Nabisco merges with both a wheat firm and milling firm. This is an example of a

A) vertical merger. B) horizontal merger. C) parallel merger. D) diagonal merger.

A financing gap is:

A. the difference between the savings rate within an economy and the amount of investment needed to achieve sustainable growth. B. the extra savings a country has beyond that needed to achieve sustainable growth. C. the difference in the amount of investment dollars coming in to a country and the amount of investment dollars going out of a country. D. the extra investment developing countries need in foreign aid to sustain their current rate of growth.

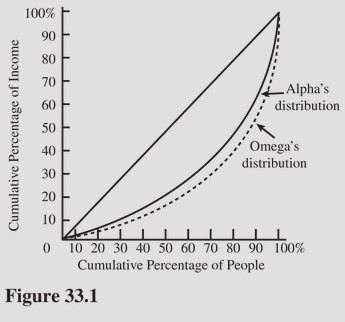

The size distribution of income in Figure 33.1 reveals that

The size distribution of income in Figure 33.1 reveals that

A. The Gini coefficient for Alpha is larger than for Omega. B. Incomes are more equally distributed in Omega than in Alpha. C. People are wealthier in Alpha than in Omega. D. Incomes are more equally distributed in Alpha than in Omega.

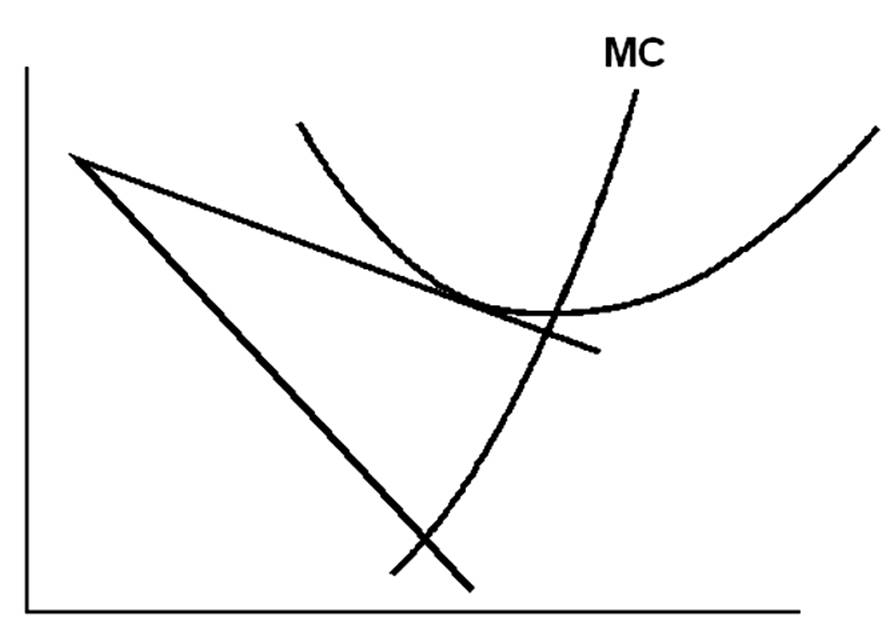

The graph above shows a monopolistic competitor

A. in the short run taking a loss.

B. in the short run making a profit.

C. in the long run breaking even.

D. in the long run taking a loss.