Economist A believes that the case for government is a strong one, but she doesn't always say, when it comes to negative externalities, that government can turn an inefficient market outcome into an efficient outcome. Which statement is economist A most likely to make?

A) If the tax placed on the activity that generates the negative externality is too large, we are not likely too move from inefficiency to efficiency.

B) If the subsidy placed on the activity that generates the negative externality is too small, we are not likely to move from inefficiency to efficiency.

C) If there is a free rider problem, then government cannot solve the problem of negative externalities.

D) a and b

E) none of the above

A

You might also like to view...

According to the assumptions of the quantity theory of money, if the money supply decreases by 7 percent, then

a. nominal and real GDP would fall by 7 percent. b. nominal GDP would fall by 7 percent; real GDP would be unchanged. c. nominal GDP would be unchanged; real GDP would fall by 7 percent. d. neither nominal GDP nor real GDP would change.

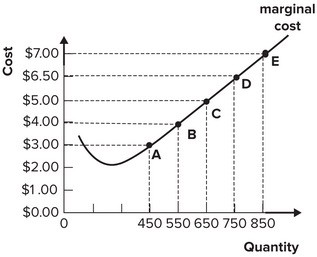

Refer to the graph shown. If market price is currently $3.00 per unit, this perfectly competitive firm will maximize profit by producing:

A. 850 units of output. B. 650 units of output. C. between 550 and 650 units of output. D. 450 units of output.

Recall the Application about price discrimination using refillable soda bottles to answer the following question(s).According to the Application, how does the firm earn a larger profit through the refillable soda bottles?

A. The consumers who were not likely to buy the soda get a lower price, making them more likely to purchase soda. B. The seller saves money from recycling the disposable bottles. C. The seller earns more revenue from sale of the expensive recyclable bottles. D. The consumers advertise to friends that the seller gives discount through refillable bottles, causing an increase in demand.

"Creating a free market for carbon-dioxide emission permits would only encourage firms to pollute more." Do you agree or disagree? Why?

What will be an ideal response?