If the current exchange rate is 1.00 euro per dollar and the expected exchange rate at the end of the month rises to 1.20 euros per dollar, then the demand for dollars ________ because people expect holding of dollars to become ________ profitable

A) decreases; more

B) increases; less

C) increases; more

D) does not change; neither more nor less

E) decreases; less

C

You might also like to view...

If the Fed follows a policy of fixed exchange rates, an undervalued dollar will force the Fed to

a. conduct open market purchases. b. raise the discount rate. c. raise the required reserve ratio. d. cut taxes or raise government spending.

A decrease in demand shifts the demand curve to the left

a. True b. False Indicate whether the statement is true or false

For private goods allocated in markets,

a. prices guide the decisions of buyers and sellers and these decisions lead to an efficient allocation of resources. b. prices guide the decisions of buyers and sellers and these decisions lead to an inefficient allocation of resources. c. the government guides the decisions of buyers and sellers and these decisions lead to an efficient allocation of resources. d. the government guides the decisions of buyers and sellers and these decisions lead to an inefficient allocation of resources.

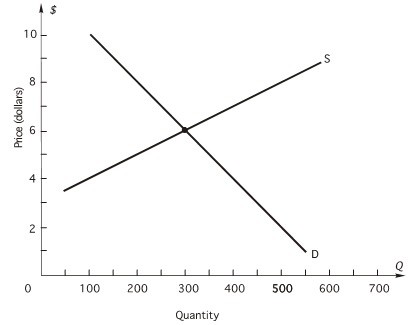

Refer to the figure below: Let supply remain constant at S; a decrease in income causes consumers to be willing and able to purchase 150 fewer units at each price than they were previously.

Let supply remain constant at S; a decrease in income causes consumers to be willing and able to purchase 150 fewer units at each price than they were previously.

A. The new equilibrium price and quantity will be P = $7 and Q = 250. B. The new equilibrium price and quantity will be P = $6 and Q = 150. C. The new equilibrium price and quantity will be P = $5 and Q = 200. D. The new equilibrium price and quantity will be P = $5 and Q = 150.