In 2014, which type of tax raised the most revenue for the U.S. federal government? Which type of tax raised the most revenue for state and local governments?

What will be an ideal response?

In 2014, individual income taxes raised the most revenue for the federal government, and sales taxes raised the most revenue for state and local governments.

You might also like to view...

All of the following are true statements about the multiplier except

A) the multiplier effect occurs when autonomous expenditure changes. B) the multiplier is a value between zero and one. C) the smaller the MPS, the larger the multiplier. D) the multiplier rises as the MPC rises.

Nonactivists believe that ________

A) there is a very rapid self-correcting mechanism since prices and wages are very flexible B) lags to policy implementation are so long that even the "correct" policies may lead to undesirable consequences C) policy interventions should take place less frequently than what Keynesians advocate D) all of the above E) none of the above

Suppose the price level falls. The result is that the:

a. aggregate supply curve would shift to the right. b. aggregate supply curve would shift to the left. c. general price level would rise causing a movement up the aggregate demand curve. d. aggregate demand curve would slope downward because of the real balances effect.

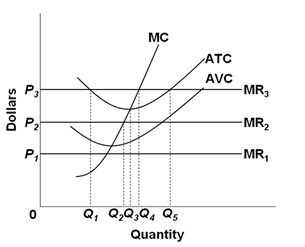

Refer to the graph below. All data are for the short run. Which of the following statements is correct?

A. Production is profitable only when price is above P3

B. Average fixed cost is P1 P3 at output Q1

C. The firm will produce an output of Q1 when price is P1

D. At price P1, the firm will close down