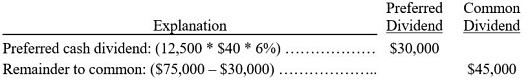

A corporation had the following stock outstanding when the company's board of directors declared a $75,000 cash dividend in the current year:Preferred stock, $40 par, 6%, 12,500 shares issued$ 500,000Common stock, $10 par, 70,000 shares issued ……………. 700,000Total ………………………………………………………..$1,200,000Allocate the cash dividend between the preferred and common stockholders assuming the preferred stock is noncumulative and nonparticipating.

What will be an ideal response?

You might also like to view...

If the yield curve slope is flat, the liquidity premium theory indicates that the market is predicting

A) a mild rise in short-term interest rates in the near future and a mild decline further out in the future. B) constant short-term interest rates in the near future and further out in the future. C) a mild decline in short-term interest rates in the near future and a continuing mild decline further out in the future. D) constant short-term interest rates in the near future and a mild decline further out in the future.

Practicing intelligent disobedience is a four-step process. Briefly describe each step.

What will be an ideal response?

Any code that helps the data-entry person remember how to enter the data or the end-user remember how to use the information can be considered an alphabetic derivation code

Indicate whether the statement is true or false

Services performed by service departments for the benefit of an operating department are called interdepartmental services.

Answer the following statement true (T) or false (F)