In 2011, the 20 percent of families with the lowest incomes paid an average federal tax rate (on all federal taxes) of about ________, whereas the 20 percent of families with the highest incomes paid an average tax rate of about ________.

A. 8.4 percent; 29 percent

B. 10.3 percent; 30.9 percent

C. 4.0 percent; 35 percent

D. 1.9 percent; 23.4 percent

Answer: D

You might also like to view...

The temptation of imperfectly-monitored workers to shirk their responsibilities is

a. an example of the moral hazard problem. b. an example of the adverse selection problem. c. an example of screening. d. an example of signaling.

Suppose consumers of cigarettes can be classified into two groups: heavy users and light users. Heavy users purchase more cigarettes and are less sensitive to price changes relative to light users. To determine whether a heavy user suffers a greater loss of consumer surplus than a light user does when the price of cigarettes increases, one would need to know

A) each group's average income. B) the actual quantities purchased by each. C) each individual's price elasticity of demand. D) no additional information.

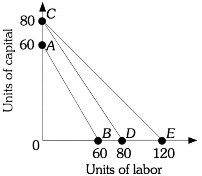

Refer to the information provided in Figure 7.8 below to answer the question(s) that follow.  Figure 7.8Refer to Figure 7.8. If the price of capital is $30, then along isocost line AB total cost is

Figure 7.8Refer to Figure 7.8. If the price of capital is $30, then along isocost line AB total cost is

A. $1,200. B. $1,800. C. $2,400. D. indeterminate from this information, as the price of labor is not given.

The price of a good will be demand determined if

A. the supply of the good is perfectly elastic. B. the demand for the good is unit elastic. C. the supply of the good is perfectly inelastic. D. the demand for the good is perfectly inelastic.