Suppose that you are a bank manager, and the Federal Reserve raises the required reserve ratio from 10% to 12%. What actions would you need to take?

A. You would have to reduce lines to make up for the necessary increase in reserves

B. You would need to make loans to match the new reserve requirement

C. You would have to charge less for your loans because rates are now at 12%

Ans: A. You would have to reduce lines to make up for the necessary increase in reserves

You might also like to view...

During the twentieth century, the market structure of the U.S. economy has

A) become less competitive. B) remained about the same. C) become more competitive. D) become mostly monopolies.

Which of the following is NOT an example of product differentiation?

A. A publisher that prints out-of-print books for a customer. B. A local pub where the bartenders put on a juggling act with the bottles before they mix your drink. C. Corn from an Iowa cornfield vs. corn from an Illinois cornfield. D. The Fudge Factory where the workers sing and tell jokes while they make fudge.

A legal promise to repay a debt is called:

A. a dividend. B. a bond. C. equity. D. a stock.

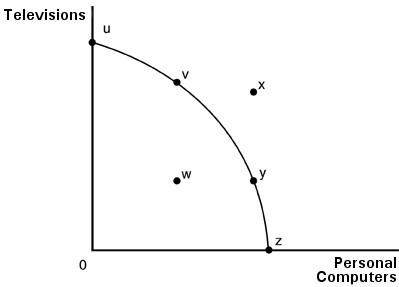

In the above figure, the combination of personal computers and televisions shown by point w

In the above figure, the combination of personal computers and televisions shown by point w

A. is an efficient use of society's resources because it is below the production possibilities curve. B. is attainable but involves the inefficient use of some of society's resources. C. is beyond the capacity of society to produce. D. is more desirable than point x because producing at point w does not put a strain on society's resources.