The manager of a local fast-food restaurant is interested in improving service provided to customers who use the restaurant's drive-up window. As a first step in the process, the manager asks his assistant to record the time (in minutes) it takes to serve a large number of customers at the final window in the facility's drive-up system. The given frame in this case is 200 customer service times observed during the busiest hour of the day for this fast-food restaurant. The frame of 200 service times yielded a mean of 0.881. A simple random sample of 10 from this frame is presented below.

Customer1

2

3

4

5

6

7

8

9

10

Service time1.02

1.18

0.95

0.90

0.85

1.10

0.75

0.60

1.25

1.00

(A) Compute the point estimate of the population mean from the sample above. What is the sampling error in this case? Assume that the population consists of the given 200 customer service times.(B) Compute the point estimate of the population standard deviation from the sample above.(C) Should you use the finite population correction (fpc) factor to estimate the standard error of

What will be an ideal response?

= 0.96. Then, sampling error = 0.96 - 0.881 = 0.079

= 0.96. Then, sampling error = 0.96 - 0.881 = 0.079(B) s = 0.1963

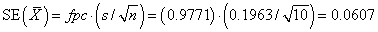

(C) Yes, we should use the finite population correction factor in this case, since a sample size of 10 is 5% of population size of 200. Here fpc =

(D)

You might also like to view...

A note receivable due in 18 months is listed on the balance sheet under the caption

A) long-term liabilities B) fixed assets C) current assets D) investments

Perhaps no one understands how influential the Beatles were more than ________

A) her B) she C) herself

Describe the legal implications involved in denying credit

The current FUTA tax rate is 0.6%, and the SUTA tax rate is 5.4%. Both taxes are applied to the first $7,000 of an employee's pay. Assume that an employee earned total wages of $2,900 in the current period and had cumulative pay for prior periods of $5,800. What is the amount of unemployment taxes the employer must pay on this employee's wages for the current period?

A. $72.00. B. $348.00. C. $0.00. D. $174.00. E. $420.00.