If the interest rate on euro-denominated assets is 13 percent and it is 15 percent on peso-denominated assets, and if the euro is expected to appreciate at a 4 percent rate,

for Manuel the Mexican the expected rate of return on euro-denominated assets is

A) 11 percent.

B) 13 percent.

C) 17 percent.

D) 19 percent.

C

You might also like to view...

Given the following data for the economy, compute the value of GDP.Government purchases of goods and services10Consumption Expenditures70Exports5Imports12Change in inventories-7Construction of new homes and apartments15Sales of existing homes and apartments22Government payments to retirees17Business fixed investment9

A. 56 B. 141 C. 83 D. 90

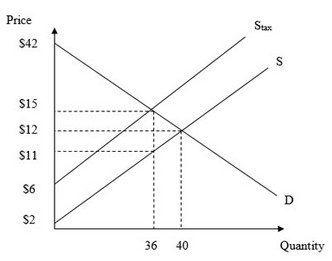

Use the figure below to answer the following question. What is the amount of government revenue after the government imposes the excise tax on the market?

What is the amount of government revenue after the government imposes the excise tax on the market?

A. $540 B. $162 C. $486 D. $144

Consider the following entry game: Here, firm B is an existing firm in the market, and firm A is a potential entrant. Firm A must decide whether to enter the market (play "enter") or stay out of the market (play "not enter"). If firm A decides to enter the market, firm B must decide whether to engage in a price war (play "hard"), or not (play "soft"). By playing "hard," firm B ensures that firm A makes a loss of $2 million, but firm B only makes $2 million in profits. On the other hand, if firm B plays "soft," the new entrant takes half of the market, and each firm earns profits of $4 million. If firm A stays out, it earns zero while firm B earns $8 million. Which of the following are perfect equilibrium strategies?

A. (enter, soft) B. (not enter, hard) C. (enter, hard) D. (not enter, soft)

Capital is the cushion banks have against:

A. liquidity risk. B. an unexpected decrease in liabilities. C. moral hazard. D. sudden drops in the value of their assets.