Derive the relation between savings, domestic investment, and net capital outflow using the national income accounting identity

Start from the national income accounting identity,

(1) Y = C + I + G + NX.

Recall from Chapter 25 that national saving is the income that is left after paying for current consumption and government expenditure,

(2) S = Y - C - G.

Rearranging, (1) we obtain Y - C - G = I + NX, and substituting in (2)

(3) S = I + NX.

Because net exports also equal net capital outflow, we can also write this equation as

(4) S = I + NCO.

You might also like to view...

How do firms respond to unplanned inventory changes? What is the effect on their production and GDP?

What will be an ideal response?

Suppose the price of a product is less than its average variable cost. When the firm's fixed obligations are completely ended, it will now most likely:

a. make an economic profit. b. go out of business. c. expand to a bigger operation. d. continue to be shut down. e. break even.

The difference between the purchase price of a financial asset and the sale price of the asset is called a(n)

a. capital gain. b. dividend. c. profit. d. investment.

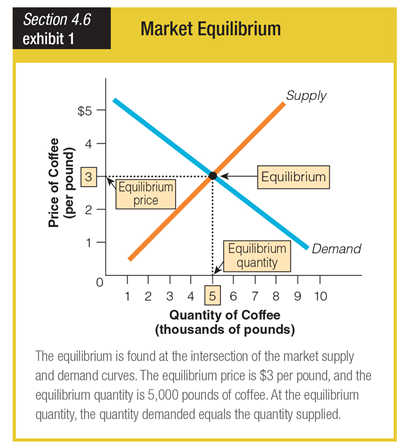

The equilibrium point is at the intersection of the two curves because ______.

a. market demand equals market supply

b. market demand exceeds market supply

c. market demand is less than market supply

d. market demand is unrelated to market supply