When tax revenues exceed the government's outlays, the budget

A) has a surplus and the national debt is decreasing.

B) is balanced and the national debt is decreasing.

C) has a deficit and the national debt is increasing.

D) has a surplus and the national debt is increasing.

E) None of the above because by law tax revenue cannot exceed the government's expenditures.

A

You might also like to view...

Does it appear that currency boards make fixed exchange rates credible?

What will be an ideal response?

In the classical theory of aggregate demand, a decrease in the velocity of money leads to

a. a downward shift in the aggregate demand curve, a fall in prices, and no change in output. b. an increase in the aggregate demand curve, a rise in prices, and no change in output. c. no change in aggregate demand or supply because higher velocity increases the money supply. d. an upward shift in the aggregate demand curve, a fall in prices, and no change in output.

Which of the following would cause a fall in the market interest rate?

a. an increase in the risk cost of investment b. an increase in the inflation rate c. an increase in the marginal rate of return on investment d. a decrease in the marginal product of capital e. none of the above

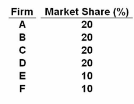

Refer to the data. The four-firm concentration ratio for this industry is:

A. 90 percent.

B. 95 percent.

C. 100 percent.

D. indeterminate because we don't know which four firms are included.