Which of the following is not correct?

a. There is a greater reduction in risk by increasing the number of stocks in a portfolio from 1 to 10, than by increasing it from 100 to 120 stocks.

b. The historical rate of return on stocks has been about 5 percentage points higher than the historical rate of return on bonds.

c. Stock in an industry that is very sensitive to economic conditions is likely to have a higher average return than stock in an industry that is not so sensitive to economic conditions.

d. If you had information about a corporation that no one else had, you could earn a very high rate of return. This contradicts the efficient market hypothesis.

d

You might also like to view...

Natural Gas Boom Technological improvements in hydraulic fracturing, or "Fracking," have decreased the cost of extracting smaller pockets of natural gas. What affect does this have on supply and demand as well as on the equilibrium price and quantity?

When drawing a demand curve,

a. demand is measured along the vertical axis, and price is measured along the horizontal axis. b. quantity demanded is measured along the vertical axis, and price is measured along the horizontal axis. c. price is measured along the vertical axis, and demand is measured along the horizontal axis. d. price is measured along the vertical axis, and quantity demanded is measured along the horizontal axis.

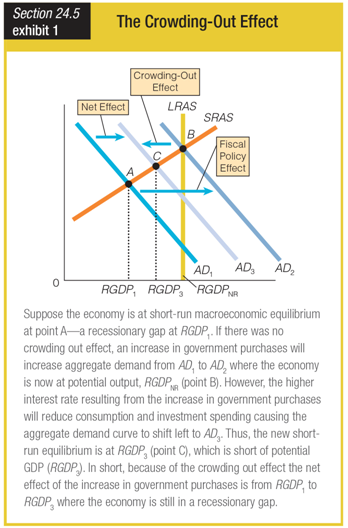

Based on the graph showing the crowding-out effect, the crowding-out effect ______ aggregate demand.

a. increases

b. decreases

c. eliminates

d. has no effect on

The rate of interest that you pay on a home loan depends upon all of the following EXCEPT

A. the supply of houses in the real estate market. B. your credit rating. C. handling charges or loan fees. D. the length of the loan.