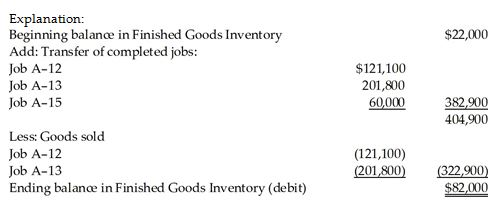

On January 1, Feldstein Manufacturing had a beginning balance in Work-in-Process Inventory of $81,100 and a beginning balance in Finished Goods Inventory of $22,000. During the year, Feldstein incurred manufacturing costs of $351,000.

During the year, the following transactions occurred:

Job A-12 was completed for a total cost of $121,100 and was sold for $126,700.

Job A-13 was completed for a total cost of $201,800 and was sold for $211,000.

Job A-15 was completed for a total cost $60,000 but was not sold as of year-end.

What was the balance in Finished Goods Inventory at the end of the year?

A) $404,900 debit balance

B) $82,000 credit balance

C) $82,000 debit balance

D) $382,900 debit balance

C) $82,000 debit balance

You might also like to view...

A company would most likely choose the carryforward option for a net operating loss if the company expected

a. higher tax rates in the future compared to the past. b. lower tax rates in the future compared to the past. c. lower earnings in the future compared to the past. d. higher earnings in the future compared to the past.

Adjectives ____

A) modify verbs, adjectives, or other adverbs B) join nouns and pronouns to other words in a sentence C) act as substitutes for nouns D) describe nouns or pronouns

Unions have a legal obligation to provide assistance to members who are pursuing grievances under

A. the Wagner Act. B. the Taft-Hartley Act. C. the fair representation doctrine. D. the right-to-work statute.

A Court may make an order dissolving a partnership on which of the following grounds?

A) the business conducts illegal activities B) one partner becomes mentally incompetent C) dissolution is equitable D) the business is continually operating at a loss E) all of the above