If asset A is a 30-year U.S. Treasury bond yielding 9 percent and asset B is a 30-year corporate bond issued by General Motors that also yields 9 percent, risk averse investors would

A) prefer asset A.

B) prefer asset B.

C) be indifferent between the two assets.

D) differ according to their rate of time preference.

A

You might also like to view...

Explain why specialization and trade increases a country's overall level of consumption

What will be an ideal response?

The state government requires all persons to pay 5% of their incomes in income tax.This is an example of:

a. The benefits principle b. a proportional tax c. a regressive tax d. a progressive tax

The elasticity that measures the responsiveness of consumer demand to changes in income is the:

A. neither the income elasticity, the own price elasticity, nor the cross-price elasticity. B. own price elasticity. C. cross-price elasticity. D. income elasticity.

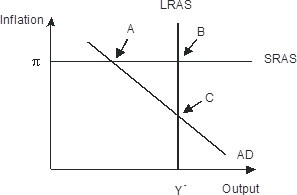

The economy pictured in the figure below has a(n) ________ gap with a short-run equilibrium combination of inflation and output indicated by point ________.

A. recessionary; B B. recessionary; C C. recessionary; A D. expansionary; A