The opportunity cost of an action is the:

A. cost of all alternative actions that could have been taken.

B. monetary payment the action required.

C. value of the most highly valued alternative action given up.

D. None of the statements associated with this question are correct.

Answer: C

You might also like to view...

Firm A and firm B both have total revenues of $200,000 and total costs of $250,000; firm A has total fixed costs of $40,000, while firm B has total fixed costs of $70,000. Which of the following statements are true in the short run?

A. Firm A should operate. B. Firm B should operate. C. Firm A should shut down. D. Firm B should shut down. E. both b and c

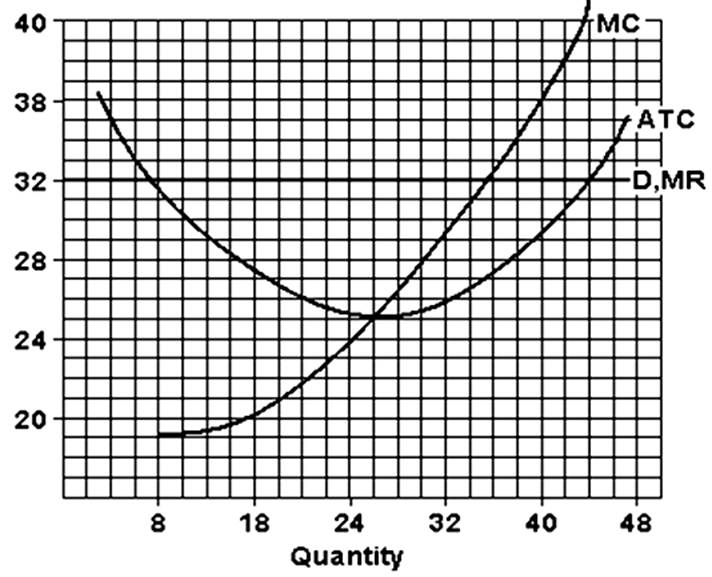

How much are the firm's total profits in the graph above?

The price of a new textbook is $120 in one year and is $150 two years later, while the price of a used copy of the text increased from $40 to $60. The relative price of a new textbook

A. decreased from 3 to 2.5. B. increased from 3 to 4.5. C. decreased from 0.8 to 0.67. D. remained constant.

Dividends are

A) financial securities which represent ownership in a corporation. B) the yearly payments associated with bonds. C) the interest rate paid on shares of stock. D) payments by a corporation to its shareholders.