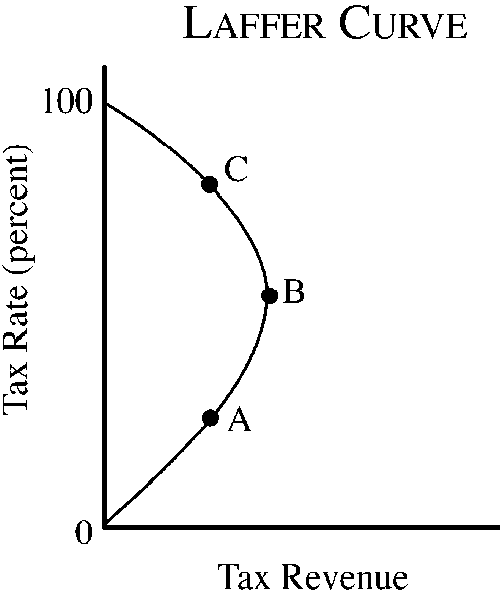

Figure 4-11 Refer to . On the Laffer curve shown, which of the following is true?

a. Tax revenue would increase if marginal tax rates were lowered from point C.

b. Tax revenue would decrease if marginal tax rates were lowered from point A.

c. Tax revenues are maximized at a tax rate corresponding to point B.

d. All of the above are true.

d

You might also like to view...

Firms have incentive to enter a monopolistically competitive market if:

A. positive profits are being earned and the price is below MC. B. zero profits are being made and they can duplicate the product exactly. C. positive profits are being earned and they can create a similar product. D. zero profits are being made and they can create a similar product.

Higher interest rates make it:

A. more expensive to borrow. B. harder to get a loan typically. C. easier to get a loan typically. D. less expensive to borrow.

Suppose that the EPA has proposed strict controls on the amount of sulfur that diesel fuel contains. These controls were designed to fully offset the cost of pollution generated by diesel fuel vehicles. The effect of the regulation is estimated to increase the equilibrium price of a gallon of diesel fuel by 10 cents. Suppose that demand for diesel fuel is perfectly inelastic and supply has a positive slope. The effect of the regulation will ________ than if demand were not perfectly inelastic.

A. increase price and quantity by more B. increase price by more and reduce quantity by less C. decrease price and quantity by more D. increase price by less and reduce quantity by more

We can calculate how long a country will take to double its real GDP per capita using:

A. the GDP growth estimator. B. its GDP deflator. C. its average growth rate. D. the CPI indexation factor.