A margin call is when:

A. it looks like you are in danger of running through your money, and your broker forces you to sell your stock and use the money to pay back your loan.

B. the market reaches a tipping point, and the financial bubble bursts.

C. prices on future values of a stock are forecasted to be lower than current prices.

D. prices on future values of a stock are forecasted to be higher than current prices.

A. it looks like you are in danger of running through your money, and your broker forces you to sell your stock and use the money to pay back your loan.

You might also like to view...

If the nominal interest rate is less than the equilibrium nominal interest rate determined in the money market, then households and firms

A) are holding less money than they prefer. B) are holding more money than they prefer. C) expect real GDP to increase. D) expect the price level to increase. E) expect the nominal interest rate to decrease.

Scarcity:

a. allows businesses to take advantage of economies of scale. b. means that human wants for goods, services and resources exceed what is available. c. means that as the level of production increases, the average cost of producing each individual unit declines. d. only refers to resources, such as labor, tools, land, and raw materials.

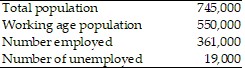

Using the above table, the labor force participation rate is

Using the above table, the labor force participation rate is

A. 69.1 percent. B. 81.8 percent. C. 65.6 percent. D. 73.8 percent.

The relationship of dead capital to inefficient production is

A. that outdated equipment will lead to inefficient production. B. nonexistent since the capital is already dead. C. that without clear ownership it is not possible to sell or transfer a resource so that it can be used efficiently. D. that when the dead capital is replaced by more technologically advanced capital, economic growth occurs.