One of the major functions of financial markets is to help people reduce risk. Describe two financial methods people can use to reduce their exposure to risk

What will be an ideal response?

People can use a futures contract, which is a financial instrument that establishes the terms of a sale that will take place at a later time. This locks in a price at the time the contract is written and eliminates the risk that the price may unfavorably change when delivery of the product is actually made in the future.

People can also diversify to reduce exposure to risk. Diversification is the process of spreading wealth across multiple investments. This reduces the chance of one bad investment destroying a large percentage of wealth.

You might also like to view...

Which of the following is a likely result of the deregulation of the airline industry that might benefit consumers?

a. a wage increase for union pilots b. a possible decline in airline safety c. one firm's emerging as an unregulated monopoly d. loss of service to unprofitable routes e. a decrease in air fares

Many economists believe that tax cuts increase incentives to work and invest but current U.S. tax levels do not appear to be on the downward side of the Laffer curve

a. True b. False Indicate whether the statement is true or false

Refer to the information provided in Table 36.2 below to answer the question(s) that follow. Table 36.2 PointAggregate Income (Y)Aggregate Consumption (C) A 10 14 B 20 23 C 30 25 D 40 26 E 50 34 F 60 39The data in the table was used to estimate the following consumption function: C = 12 + 0.4YRefer to Table 36.2. The error for point D is equal to

A. -2. B. -1. C. +2. D. +4.

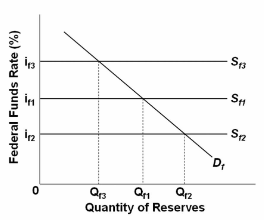

Refer to the diagram for the federal funds market. If the Fed wants the federal funds rate to fall from i f1 to i f2 , it can use open-market operations to:

A. increase the demand for federal funds.

B. increase the supply of federal funds.

C. decrease the supply of federal funds.

D. decrease commercial bank reserves.