Assume you have a total of $200,000 to invest in two corporate stocks identified as Z1 and Z2. The overall rate of return you require on the $200,000 is 26% per year. (a) If $40,000 is invested in Z2 with an estimated * 2Zi of 14% per year, what value must * 1Zi exceed to realize at least 26% per year? (b) If the best return expected from the Z1 stock is 27%, determine the threshold level of investment in Z2 to maintain an overall ROR of 26% per year. Solve by hand or using Goal Seek, as instructed.

What will be an ideal response?

(a) 40,000(0.14) + (200,000 – 40,000)(i* Z1 ) = 200,000(0.26)

i* Z1 = 0.29 (29% per year)

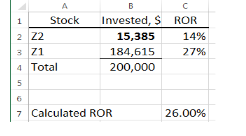

(b) Goal Seek results are shown. Thresehold investment in Z2 is $15,385. Any more than

$15,385, and the overall ROR falls below 26%.

You might also like to view...

Plat

What will be an ideal response?

The horse is able to sense security or the lack of security in the rider

Indicate whether the statement is true or false.

The Hall-effect switch is usually packaged as a ________-terminal device

A) 1 B) 4 C) 3 D) 2

If the width of a photoelectric beam is 1/8 inch and target diameter is 1 ¼ inches, what is the sensor response time required to perform the switching action as the object passes the detection point at 3 inches per second?

What will be an ideal response?