If the Federal Reserve increases the federal funds rate dramatically, which of the following would we expect to happen?

A. People with adjustable-rate mortgages would be better off.

B. The amount of credit card borrowing would increase.

C. The price of houses would increase.

D. The price of cars would decrease.

Answer: D

You might also like to view...

What happens to the real wage rate and potential GDP if population increases?

What will be an ideal response?

Refer to Figure 27-12. An increase in government purchases of $200 billion causes aggregate demand to shift ultimately from AD1 to AD2

Assuming a constant price level, the difference in real GDP between point A and point B will be ________ $200 billion. A) less than B) equal to C) greater than D) There is insufficient information given here to draw a conclusion.

A book that sells new for $100 will typically sell used for around

A. $100. B. $75. C. $50. D. $25.

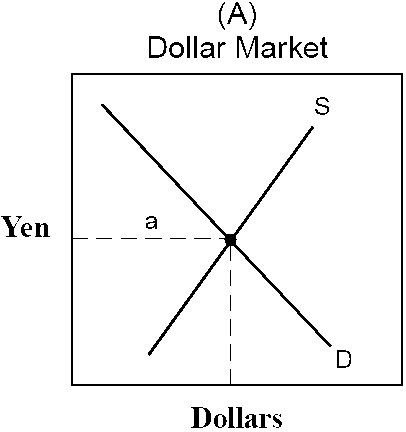

Figure 18-3

displays the international currency market for yen in terms of dollars and dollars in terms of yen. The supply curve in graph (B) is comprised of

a.

U.S. citizens attempting to purchase Japanese-made goods.

b.

Japanese attempting to purchase U.S.-made goods.

c.

U.S. businesses attempting to sell to the Japanese.

d.

Japanese businesses attempting to sell to the U.S.

e.

the U.S. government attempting to unload dollars to the international market.