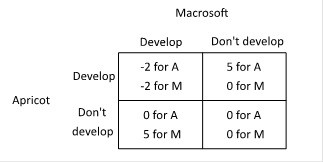

Suppose two companies, Macrosoft and Apricot, and considering whether to develop a new product, a touch-screen t-shirt. The payoffs to each of developing a touch-screen t-shirt depend upon the actions of the other, as shown in the payoff matrix below (the payoffs are given in millions of dollars).  If Macrosoft and Apricot make their decision at the same time, then which of the following statements is correct?

If Macrosoft and Apricot make their decision at the same time, then which of the following statements is correct?

A. The only Nash equilibrium is that both develop a touch-screen t-shirt.

B. The game does not have a Nash equilibrium.

C. The game has more than one Nash equilibrium.

D. The only Nash equilibrium is that neither develops a touch-screen t-shirt.

Answer: C

You might also like to view...

The adverse selection problem in international investment means

A) that those seeking funds for the riskiest projects are those most actively seeking the funds. B) that the recipients of the funds may use the funds for other than the approved projects. C) that government officials may demand higher than the usual amount of bribes. D) those in the highest levels of government are the most dishonest.

If the government budget deficit increases, which curve in the market for loanable funds shifts, which direction does it shift, and what happens to the interest rate?

Illegal gambling on the NCAA Final Four would be included in GDP.

Answer the following statement true (T) or false (F)

All of the following are reasons average workers in the United States today produce more than their counterparts a century ago EXCEPT that the modern worker:

A. is better educated. B. has more physical capital to work with. C. has better technology to work with. D. works longer hours.