You expect KT industries (KTI) will have earnings per share of $5 this year and expect that they will pay out $1.25 of these earnings to shareholders in the form of a dividend

KTI's return on new investments is 13% and their equity cost of capital is 15%. The expected growth rate for KTI's dividends is closest to ________.

A) 11.3%

B) 9.8%

C) 5.9%

D) 3.9%

Answer: B

You might also like to view...

Remaz Corp purchased equipment at a cost of $220,000 in January, 2015 . As of January 1, 2016, depreciation of $160,000 had been recorded on this asset. Depreciation expense for 2014 is $50,000 . After the adjustments are recorded and posted at December 31, 2016, what are the balances for the Equipment and Accumulated Depreciation? Equipment Accumulated Depreciation

a. $220,000 $210,000 b. $220,000 $ 0 c. $160,000 $ 50,000 d. $120,000 $210,000

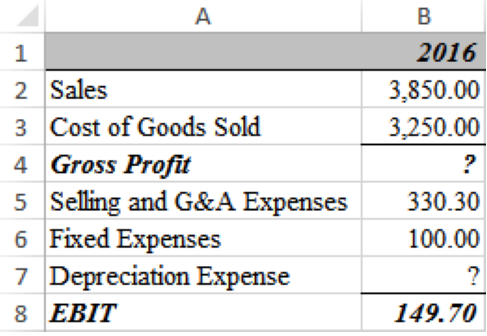

Which formula will calculate depreciation in B7?

a) =(B5+B6)–(B8-B3)

b) =B4-SUM(B5:B6)-B8

c) =(B5+B6)–(B8+B3)

d) =(B5-B6)+(B8-B4)

e) =B5-B6-B8+B2

A manager of the cereal bar at the college campus has determined that the profit made for each bowl of Morning Buzz cereal sold, x, is equal to: Z = $4x - 0.5x

Each bowl of Morning Buzz weighs 6 ounces, and the manager has 12 lbs (192 ounces) of cereal available each day, which can be written as the constraint, 6x ? 192. What maximum profit will be made from Morning Buzz if it is all sold in one day?

FIFO uses the ________ cost for cost of goods sold on the income statement and the ________ cost for inventory on the balance sheet.

A. newest; oldest B. oldest; oldest C. newest; newest D. oldest; newest