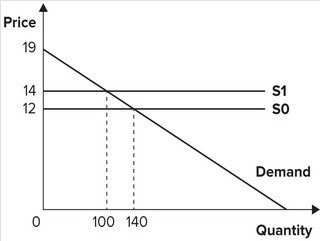

Refer to the graph shown. Initially, the market is in equilibrium with price equal to $12 and quantity equal to 140. As a result of a per-unit tax imposed by the government, the supply curve shifts from S0 to S1. The effect of the tax is to:

A. reduce consumer surplus by $240.

B. give government tax revenues of $100.

C. reduce consumer surplus by $200.

D. give government tax revenues of $280.

Answer: A

You might also like to view...

The above figure shows the market for pizza. Which figure shows the effect of an increase in the price of sandwiches, which for consumers are substitutes for pizza?

A) Figure A B) Figure B C) Figure C D) Figure D

Over the long run, taxes and government expenses have

A) remained relatively stable. B) decreased. C) increased. D) drifted apart.

The least-cost way of producing a particular rate of output is represented by a point of tangency between a short-run average cost curve and the

a. total cost curve b. short-run average total cost curve c. average variable cost curve d. long-run average cost curve e. marginal cost curve

At higher interest rates, people will hold more money.

a. true b. false