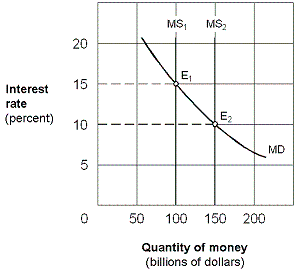

Exhibit 20-3 Money market demand and supply curves

?

In Exhibit 20-3, assume an equilibrium with an interest rate of 15 percent and the money supply at $100 billion. The Fed uses its policy tools to move the economy to a new equilibrium at E2 with money supply of $150 billion and an interest rate of 10 percent. This change could be the result of a(n):

A. open market sale of securities by the Fed.

B. higher discount rate set by the Fed.

C. higher required-reserve ratio set by the Fed.

D. open market purchase of securities by the Fed.

Answer: D

You might also like to view...

What is the relationship between the bowed out shape of the production possibilities frontier and the increasing opportunity cost of a good as more of it is produced?

What will be an ideal response?

In determining whether and how much of a public good to provide, cost-benefits analysts use the same type of price signals for public goods as are readily available for private goods

a. True b. False Indicate whether the statement is true or false

If a savings account pays 7% interest, then according to the rule of 70 how long will it take for the account balance to double?

The disadvantages of government intervention include

A. reduced regulation. B. lower taxation. C. incentive problems. D. achieving desirable goals.