Consider a situation with well-behaved international lending between two countries: Atlantica and Pacifica. Assume that Pacifica is wealthier than Atlantica. Illustrate this situation using a graph that relies upon the marginal-product-of-capital curves to show the possible investments in each country according to the returns the investments produce. Use the graph to explain the gains to each country from international lending.

What will be an ideal response?

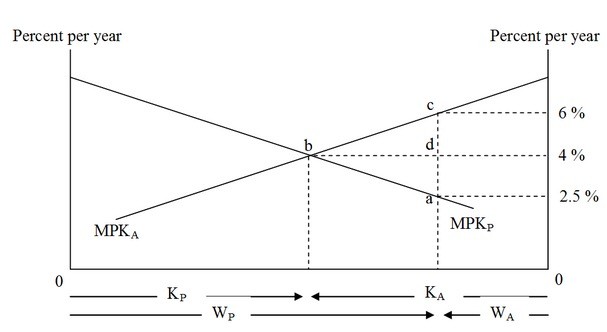

POSSIBLE RESPONSE: The diagram below illustrates the gains and losses from the investments in Atlantica and Pacifica.

The length of the horizontal axis shows total world wealth, equal to the sum of Atlantica's wealth (WA) and Pacifica's wealth (WP). This wealth is used to finance capital investments. It is evident from the figure that Pacifica has a higher wealth than Atlantica. The vertical axes show the rates of return earned on capital investments. Each curve showing the country's marginal product of capital (MPKA for Atlantica and MPKP for Pacifica, respectively) is downward sloping because of declining marginal product of capital. If international financial transactions are prohibited, each country must use its financial wealth to finance its own stock of real capital. If all Pacifica's wealth is used domestically, Pacifica's lenders receive a low rate of return at home of 2.5 percent. The scarcity of wealth in Atlantica prevents any capital formation to the left of the point 'c'.

Competition for the scarce funds bids up the interest rate in Atlantica to 6 percent.

Investors in Atlantica receive a 6 percent rate of return. So, in the absence of international lending, Pacifica's domestic investment is at Point 'a' on the MPKP curve with a return of 2.5 percent and Atlantica's domestic investment is at Point 'c' on the MPKA curve, with a return of 6 percent. When international financial transactions are allowed, the lenders in Pacifica will start lending a part of their funds to Atlantica. Over time, their lending to Atlantica will allow more capital formation in Atlantica with less capital formation in Pacifica. As a result of international lending, the equilibrium world interest rate will settle at Point 'b', 4 percent. The capital stock in Pacifica declines to KP and the capital stock in Atlantica rises to KA. The lenders in Pacifica will be able to invest funds beyond Point 'b' at 4 percent in the international market, which is more than their initial domestic rate. The borrowers from Atlantica will be able to borrow funds from the world market at a lesser rate (4 percent) than their initial domestic one. Pacifica gains the extra triangular-area "abd" when its investors seek the highest return across the world markets. Atlantica gains the extra triangular-area "bcd" when its borrowers look for lower lending rates from the world market. So, free international financial transactions allow the world to gain a total area of "abc". The losers are borrowers in Pacifica and lenders in Atlantica, but each country has a net gain.

You might also like to view...

A closed economy is a national economy that

A) doesn't interact economically with the rest of the world. B) has a stock market that is not open to traders from outside the country. C) has extensive trading and financial relationships with other national economies. D) has not established diplomatic relations with other national economies.

If a country had a real GDP of $500 million, and the GDP Ddeflator was 90, what is the nominal GDP?

a. $440 million b. $540 million c. $450 million d. $550 billion

The supplier of a factor of production has a reservation price of $100. The purchaser of the factor of production has a reservation price of $200. If the factor of production is unique, then:

A. a transaction will occur, and the price paid for the factor of production will be $200. B. a transaction will occur, and the price paid for the factor of production will be $100. C. a transaction will occur, and the price paid for the factor of production will be $150. D. there will be no transaction since $200 is greater than $100.

Rent seeking refers to ______.

a. politicians trading votes b. exempting homeowners from certain taxes c. using resources to gain political favor d. choosing not to vote unless it counts