Explain how usury laws can distort the market for funds. What is the most likely result if a usury law is passed and enforced?

What will be an ideal response?

A usury law sets a maximum interest rate, which can be charged on loans. Similar to any other price ceiling, it will lead to a shortage (assuming that the maximum rate is below the market equilibrium rate); quantity demanded will exceed quantity supplied at the interest rate. The result will be economic inefficiency. In order to allocate the funds that are available, lenders will be tempted to employ nonprice rationing methods. These methods may easily be interpreted as discrimination on the basis of race, gender, etc.

You might also like to view...

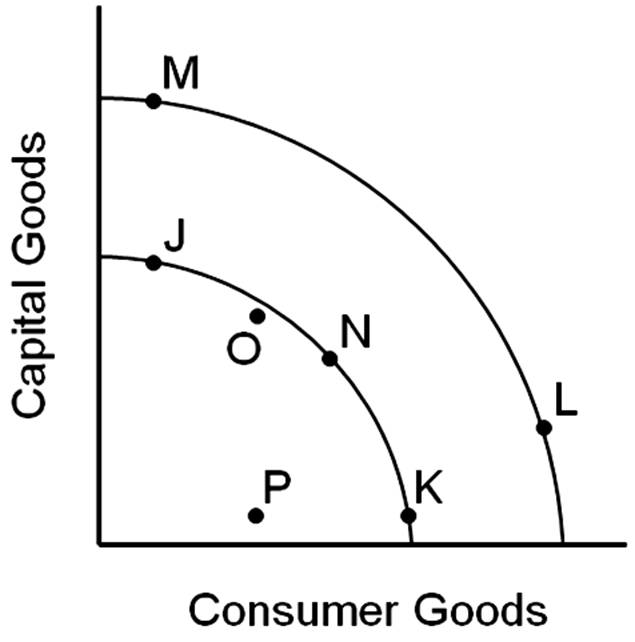

Assuming the inner curve is the United States' current production possibilities frontier, which of the following points would eventually lead to the greatest level of economic growth?

A. Point J

B. Point N

C. Point K

D. Point P

The sign of the price elasticity coefficient for a normal good will:

a. always be negative. b. always be positive. c. be positive if demand is elastic but negative if demand is inelastic. d. be positive if demand is inelastic but negative if demand is elastic.

Price increases cause a decrease in a household's choice set.

Answer the following statement true (T) or false (F)

Separation of ownership from control clearly expands the potential for principal/agent conflict. Why don't large corporations fail in large numbers because of this conflict?

What will be an ideal response?