The best way to evaluate the effect of a specific tax is _____

a. to consider the tax in isolation

b. to consider the tax in the context of the entire tax system

c. to consider whether a tax is progressive, regressive, or proportional

d. a and c

b

You might also like to view...

Cyclical unemployment exists when

A) frictional and structural unemployment is zero. B) real national income exceeds potential income. C) real GDP exceeds potential GDP. D) real GDP is less than potential GDP.

The point elasticity is a measure of the sensitivity of consumers to a large price change - a range from one price to another

a. True b. False Indicate whether the statement is true or false

Law of supply

What will be an ideal response?

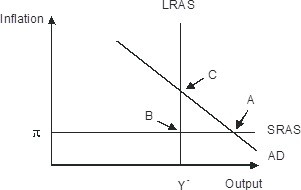

Refer to the figure below.________ inflation will eventually move the economy pictured in the diagram from short-run equilibrium at point ________ to long-run equilibrium at point ________,

A. Rising; B; C B. Falling; A; C C. Falling; A; B D. Rising; A; C