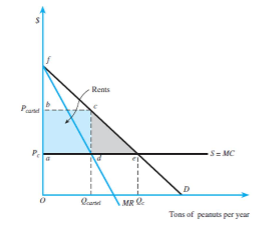

Consider Figure 6.4 in your textbook, as indicated below. If the equation for the demand curve were P = 10 - Q and MC constant at 4,

(a) Find the competitive level of output and price.

(b) Find the marginal revenue and derive the rent seeking cartel's of output and price.

(c) How much rent is being raised?

(a) Set Demand = Supply, 10 - Q = 4, then Q* = 6 and P* = 4

(b) TR = P * Q = (10 - Q) * Q, MR = dTR/dQ = 10 - 2Q, then set MR = MC, 10 - 2Q = 4, Q c = 3 and P c = 7

(c) Total rent = (P c - P*) × Q c = 3 × 3 = 9.

You might also like to view...

Use the following table, which shows a firm's production, output price, and various quantities of labor (workers) employed, to answer the next question.WorkersTotal Output per DayPrice of Good210$103151041910522106241072510What is the marginal revenue product of the fifth worker?

A. $40 B. $30 C. $20 D. $10

Explain why the FDIC is following a "too-big-to-fail" policy of fully protecting all depositors at the largest banks

What will be an ideal response?

The opportunity cost of holding excess reserves is the federal funds rate

A) minus the discount rate. B) plus the discount rate. C) plus the interest rate paid on excess reserves. D) minus the interest rate paid on excess reserves.

Mutual funds are a type of financial intermediary

a. True b. False Indicate whether the statement is true or false