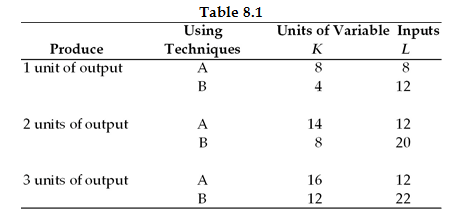

Refer to Table 8.1. Assuming the price of labor (L) is $5 per unit and the price of capital (K) is $10 per unit, what production technique should this firm use to produce 2 units of output?

A) Production technique A

B) Production technique B

C) The firm is indifferent between production technique A and production technique B.

D) It is impossible to determine if the firm should select production technique A or B because total fixed costs are not given.

B) Production technique B

You might also like to view...

If supply in the market for air filters is specified as QS = 24 + 3P, then, when conventionally graphed,

a. the vertical intercept is +24 b. the slope of the supply curve is +3 c. the horizontal intercept is +3 d. none of the above

Answer the next question on the basis of the following information about the opportunity costs of two products-fish (F) and chicken (C)-in countries Singsong and Harmony. Assume that production occurs under conditions of constant costs and these are the only two nations in the world. Finally, the opportunity costs of fish in terms of chicken are: Singsong: 1F = 2C, Harmony: 1F = 4C. Which one of the following would not be feasible terms for trade between Singsong and Harmony?

A. 1 fish for 3 chickens B. 1 fish for 2-1/2 chickens C. 1 chicken for 1/5 of a fish D. 1 chicken for 1/3 of a fish

Kate and Alice are small-town ready-mix concrete duopolists. The market demand function is Qd = 20,000 - 200P, where P is the price of a cubic yard of concrete and Qd is the number of cubic yards demanded per year. Marginal cost is $80 per cubic yard. The Cournot model describes the competition in this market. If Kate produces 10,000 cubic yards per year, what is Alice's inverse demand function?

A. P = 75 - 0.005QK B. P = 75 - 0.005QA C. P = 50 - 0.005QK D. P = 50 - 0.005QA

An individual who is a risk lover

a. values a lottery at more than its expected value b. values a lottery at exactly its expected value c. values a lottery at less than its expected value d. tends to play lots of lotteries