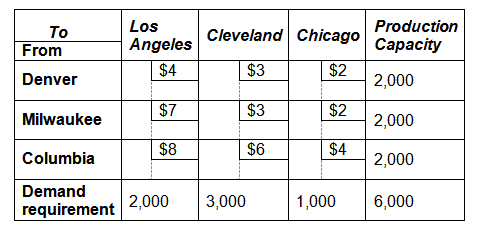

XYZ has three supply chain locations with respective production capacities of an electronic component (Denver, Milwaukee, and Columbia) and three demand locations with their respective demand requirements for that electronic component. The demand requirements, production capacities, and the per-unit transportation costs are tabled in the transportation matrix shown here. Determine the initial shipping cost using the matrix least cost method.

a. $30,000

b. $40,000

c. $24,000

d. $31,000

d. $31,000

You might also like to view...

Who usually authorizes a purchase requisition?

a. the supervisor of the requisitioning department b. the purchasing manager c. a purchasing agent d. a customer

Doug takes a $500 check drawn by Gail to Gail's drawee bank to cash it. Gail has over $10,000 on deposit in her account. If her bank refuses to pay Doug:

a. Doug can sue the bank and demand payment. b. if the check is over 30 days old, the bank has a right to refuse payment. c. the bank has incurred a liability to Gail for its improper refusal to pay the check. d. All of these.

Bridges and Lloyd, an accounting firm, provides consulting and tax planning services. For many years, the firm's total administrative cost (currently $250,000) has been allocated to services on the basis of billable hours to clients. A recent analysis found that 65% of the firm's billable hours to clients resulted from tax planning services, while 35% resulted from consulting services. The firm, contemplating a change to activity-based costing, has identified three components of administrative cost, as follows: Staff Support$180,000 In-house computing charges 50,000 Miscellaneous office costs 20,000 Total$250,000 A recent analysis of staff support found a strong correlation between the number of staff personnel and the number of clients served (consulting, 20; tax planning,

60). In contrast, in-house computing and miscellaneous office cost varied directly with the number of computer hours logged and number of client transactions, respectively. Consulting consumed 30% of the firm's computer hours and had 20% of the total client transactions.Assuming the use of activity-based costing, the proper percentage to use in allocating staff support costs to tax planning services is: A. 20%. B. 60%. C. 80%. D. 65%. E. 75%.

What is the most costly and intrusive form of authentication?

A. Something the user knows such as a user ID and password. B. Something the user has such as a smart card or token. C. Something that is part of the user such as a fingerprint or voice signature. D. None of the above.