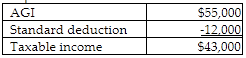

Derek, a single taxpayer, has AGI of $55,000 which includes $5,000 of qualified dividends. Derek does not itemize deductions. What is his 2018 federal income tax?

A) $5,120

B) $5,030

C) $5,400

D) $5,015

B) $5,030

The calculation of the tax is split between the tax on the $5,000 qualifying dividends and the $38,000 balance of the taxable income. The tax on the $38,000 balance of taxable income is .12($38,000 - 9,525) + $952.50 =$4,370 rounded. Dividends included in taxable income up to $38,600 are taxed at 0%, with the balance taxed until 15% until taxable income reaches $425,800. In this case, the first $600 of the $5,000 dividend income is tax-free (taxable income in the range of $38,000 - $38,600), and the $4,400 is taxed at 15%, resulting in $660 of additional tax. The total tax liability is $4,370 + $660 = $5,030.

You might also like to view...

The salary paid to the president of a company would be classified on the income statement as a(n):

A. direct labor cost. B. administrative expense. C. selling expense. D. manufacturing overhead cost.

Sales training is the effort put forth by an employer to provide the opportunity for the salesperson to receive job-related skills and knowledge that improve sales success.

Answer the following statement true (T) or false (F)

Generally, in an assignment, unless the obligor receives ________ of assignment by the obligee-assignor, the obligor has no duty to the assignee

A) notice B) gift C) delegation D) abrogation

A(n) ________ authorizes a third party to use a copyrighted work for a fee stipulated in the statute

A. compulsory copyright license B. compulsory license C. exclusive license D. statutory copyright license