Why do permanent tax cuts have a greater impact on consumption than temporary tax cuts?

a. Permanent tax cuts have a greater effect on expected long-run inflation.

b. Permanent tax cuts are perceived as minor while temporary tax cuts are larger and more effective.

c. Permanent tax cuts cause movement along the consumption function, while temporary tax cuts shift the consumption function.

d. Permanent tax cuts affect expectations of long-run income more than temporary tax cuts.

d

You might also like to view...

What method of financing government spending leads to the least crowding-out?

A) Money creation B) Taxation C) Selling bonds to the public D) Selling government assets, like national parks

Why did rising housing prices from 2001 to 2006 encourage lenders to give mortgages even to people they thought would default?

a. Lenders felt the government would pay for any losses they suffered from defaults. b. Lenders felt credit was so easy to obtain that customers in default could easily get more financing. c. Lenders felt that if borrowers defaulted that would leave the lenders with houses that were worth more than they had been owed. d. Lenders felt that regulations would soon change to help people facing foreclosure and prevent defaults.

A search good is a product

A. with qualities that consumers lack the expertise to assess without assistance. B. that an individual must consume before the quality can be established. C. that emphasizes the features of its product. D. with characteristics that enable an individual to evaluate the product's quality in advance of a purchase.

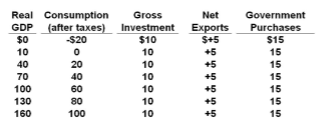

Refer to the table. The multiplier is:

A. 5.

B. 4.

C. 3.

D. 2.