You grow poplar trees. The lumber yard purchases cut trees from you. The trees grow 1 foot per year. Assuming a constant real price per foot for poplar and a real interest rate of 3%, would you sell a 20-foot tree today?

What will be an ideal response?

Do not sell yet. The tree is growing at a 5% rate. Selling the tree and putting the proceeds in the bank would only yield 3%. Wait until the tree is 33.33 feet tall.

You might also like to view...

When economists use market values to aggregate output, they sum the:

A. number of items produced. B. quantity of items produced. C. inputs of each item produced. D. price times the quantity of each item produced.

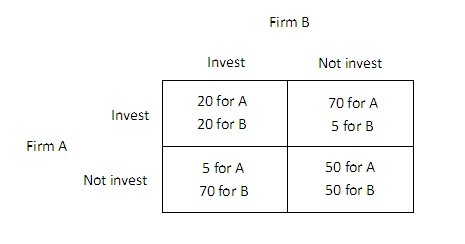

The payoff matrix below shows the payoffs (in millions of dollars) for two firms, A and B, for two different strategies, investing in new capital or not investing in new capital.  Firm A's dominant strategy is to ________, and Firm B's dominant strategy is to ________.

Firm A's dominant strategy is to ________, and Firm B's dominant strategy is to ________.

A. not invest; not invest B. invest; not invest C. invest; invest D. not invest; invest

Suppose the government want to increase aggregate demand without increasing interest rates. You would recommend

a. reducing transfer payments and increasing the money supply. b. increasing government spending and reducing the money supply. c. increasing taxes and the money supply. d. increasing government spending and the money supply.

Today, the Federal Trade Commission (FTC) is concerned with:

a. enforcing consumer protection legislation. b. prohibiting deceptive advertising. c. preventing collusion. d. all of these.