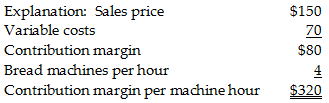

Kitchen Convenience can manufacture six toaster ovens per machine hour and four bread machines per machine hour. Kitchen Convenience's production capacity is 1600 machine hours per month. What is the contribution margin per machine hour for bread machines?

Kitchen Convenience Company manufactures two products—toaster ovens and bread machines. The following data are available:

A) $60

B) $80

C) $320

D) $480

C) $320

You might also like to view...

Answer the following statements true (T) or false (F)

1. The task environment consists of groups that present workers with daily tasks to handle. 2. Customers are those who pay to use an organization’s goods or services. 3. Customers have more faith in health insurance companies to handle complaints than they have in apparel outlets. 4. Competitors compete solely for customers and raw materials.

The LaGrange Corporation had the following budgeted sales for the first half of the current year: Cash Sales Credit SalesJanuary$70,000$340,000February$50,000$190,000March$40,000$135,000April$35,000$120,000May$45,000$160,000June$40,000$140,000?The company is in the process of preparing a cash budget and must determine the expected cash collections by month. To this end, the following information has been assembled:?Collections on sales:60% in month of sale30% in month following sale10% in second month following sale?The accounts receivable balance on January 1 of the current year was $70,000, of which $50,000 represents uncollected December sales and $20,000 represents uncollected November sales. ?The total cash collected during January by LaGrange Corporation would be:

A. $254,000 B. $410,000 C. $331,500 D. $344,000

The U.S. Supreme Court is primarily:

a. an executive court b. a high court c. an original jurisdiction court d. a district court e. none of the other choices are correct

Correll Corporation is considering a capital budgeting project that would require investing $240,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $570,000 and annual incremental cash operating expenses would be $420,000. The project would also require a one-time renovation cost of $40,000 in year 3. The company's income tax rate is 30% and its after-tax discount rate is 15%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.The income tax expense in year 2 is:

A. $27,000 B. $45,000 C. $12,000 D. $15,000