If a bond selling price was listed in the Wall Street Journal as 50, the actual selling price was:

a. $5000

b. $5

c. $250

d. $50

e. $500

e. $500

You might also like to view...

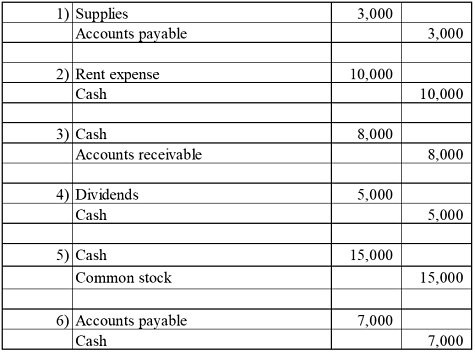

Consider each of the following general journal entries.  Required: Assume the company's return-on assets ratio is less than 1.0, debt-to-assets ratio is less than 1.0, and its return-on assets ratio is less than 1.0 before these transactions listed above took place. Consider the effect of each journal entry on these three ratios. Enter an "I" if the entry increases the ratio, a "D" if the ratio decreases the ratio, or "NC" if the ratio does not change as a result of a given transaction.

Required: Assume the company's return-on assets ratio is less than 1.0, debt-to-assets ratio is less than 1.0, and its return-on assets ratio is less than 1.0 before these transactions listed above took place. Consider the effect of each journal entry on these three ratios. Enter an "I" if the entry increases the ratio, a "D" if the ratio decreases the ratio, or "NC" if the ratio does not change as a result of a given transaction.

What will be an ideal response?

Which document is delivered to escrow by the buyer??

A)?Termite report B)?Loan commitment C)?Deed D)?None of the above

Jason is a 25 percent partner in the JJM Partnership when he sells his entire interest to Lavelle for $76,000. At the time of the sale, Jason's basis in JJM is $87,000. JJM does not have any debt or hot assets. Jason will recognize a gain of $11,000 on the sale of his partnership interest.

Answer the following statement true (T) or false (F)

Nonprogrammed decisions require human knowledge or software that has human knowledge embedded in it.

Answer the following statement true (T) or false (F)