Reporting financial assets and liabilities at fair values also is referred to as:

a. historical cost.

b. acquisition cost.

c. mark-to-market.

d. mortgage-backed cost

C

You might also like to view...

Why can deontology be problematic for a business?

a. Compulsive or consistent honesty is not conducive to good management. b. Respecting every stakeholder or customer equally is likely not sound business practice. c. Constantly seeking the welfare of the poorest members of society is at odds with seeking a company’s profits. d. Seeking the benefit of the majority can be detrimental to some key stakeholders in the minority.

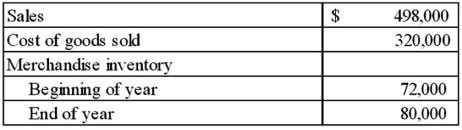

Selected financial information for Martin Company for Year 2 follows: Required:How many times did Martin's merchandise inventory turnover during Year 2? Round your answer to one decimal place.

Required:How many times did Martin's merchandise inventory turnover during Year 2? Round your answer to one decimal place.

What will be an ideal response?

A seven-octet pattern of alternating 0s and 1s used by the receiver to establish

bit synchronization is a ________. A. source address B. start frame delimiter C. preamble D. destination address

Financial statements for Maraby Corporation appear below:Maraby CorporationBalance SheetDecember 31, Year 2 and Year 1(dollars in thousands) Year 2Year 1Current assets: Cash and marketable securities$220 $190 Accounts receivable, net 190 160 Inventory 140 150 Prepaid expenses 70 80 Total current assets 620 580 Noncurrent assets: Plant & equipment, net 1,180 1,150 Total assets$1,800 $1,730 Current liabilities: Accounts payable$100 $120 Accrued liabilities 100 70 Notes payable, short term 160 160 Total current liabilities 360 350 Noncurrent liabilities: Bonds payable 450 500 Total liabilities 810 850 Stockholders' equity: Common stock, $5 par 160 160 Additional

paid-in capital 200 200 Retained earnings 630 520 Total stockholders' equity 990 880 Total liabilities & stockholders' equity$1,800 $1,730 Maraby CorporationIncome StatementFor the Year Ended December 31, Year 2(dollars in thousands)Sales (all on account)$1,960 Cost of goods sold 1,370 Gross margin 590 Selling and administrative expense 230 Net operating income 360 Interest expense 50 Net income before taxes 310 Income taxes (30%) 93 Net income$217 Maraby Corporation's acid-test (quick) ratio at the end of Year 2 was closest to: A. 1.95 B. 0.47 C. 1.14 D. 0.51