Which of the following taxes would impose the smallest excess burden on an individual?

A. a tax on all diet beverages

B. a tax on Diet Pepsi

C. a tax on all soft drinks

D. a tax on all types of beverages, including water

Answer: D

You might also like to view...

By 2016, the dollar value of the debt had climbed:

A. to 104 percent of GDP. B. to just under $500 billion. C. to $800 billion. D. down to 80 percent of GDP.

The Fed can reduce the federal funds rate by

a. decreasing the money supply. To decrease the money supply it could sell bonds. b. decreasing the money supply. To decrease the money supply it could buy bonds. c. increasing the money supply. To increase the money supply it could sell bonds. d. increasing the money supply. To increase the money supply it could buy bonds.

In a fixed exchange rate system,

A. A balance-of-payments deficit can be corrected by expansionary fiscal and expansionary monetary policies. B. A country can eliminate a surplus of its currency by eliminating its protectionist barriers to trade. C. The capital account surpluses must offset current account deficits. D. Excess demand for a currency is eliminated by using foreign exchange reserves to increase demand.

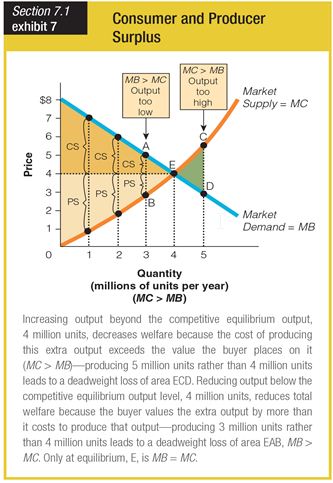

In this consumer and producer surplus graph, what happens at equilibrium (E)?

a. MB = MC

b. MB < MC

c. MB > MC

d. MB + MC = 0