According to Davis (1963), industrial firms need capital to expand, grow and develop. They will seek the most efficient means to finance this capital. In the U.S

during its period of industrialization, industrialists raised the resources needed to invest in capital accumulation by (a) tapping into the lending power of giant commercial banks.

(b) utilizing the lending power of a large number of small banks.

(c) merging.

(d) engaging in all of the above.

(b)

You might also like to view...

Even though mass transit systems such as buses are available in most cities in the United States, many residents decide to drive to work in their own vehicles because

A) the opportunity cost of riding a bus is too high for them. B) there is no opportunity cost of them to drive. C) they are not aware of the opportunity cost of driving. D) they do not behave according to the economic way of thinking.

Collusion among oligopolists would generally be easiest to achieve in which of the following situations? a. very few producers, producing differentiated products

b. very few producers, producing homogeneous products. c. a larger number of producers, producing differentiated products. d. a larger number of producers, producing homogeneous products.

Three accountants can prepare 5 tax returns a day and four accountants can prepare 7 tax returns a day. If the marginal revenue product of hiring the fourth accountant is $300, then in a perfectly competitive product market the price of each tax return is

a. $250 b. $100 c. $300 d. $200 e. $150

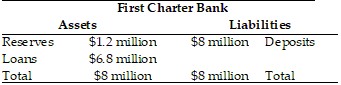

Refer to the information provided in Table 25.4 below to answer the question(s) that follow.Table 25.4 Refer to Table 25.4. First Charter Bank could make additional, first round loans of $400,000 if the required reserve ratio were

Refer to Table 25.4. First Charter Bank could make additional, first round loans of $400,000 if the required reserve ratio were

A. 12%. B. 10%. C. 8%. D. 7.5%.