One way the government decides how to pay for a public good is:

A. the transfer of surplus.

B. the ease of collecting payout.

C. if they can make the good excludable and charge its users.

D. All of these are ways the government allocates payment of public goods.

Answer: C

You might also like to view...

When the coupon rate on newly issued bonds ________ relative to older, outstanding bonds, the market price of the older bond ________

A) increases; rises in the secondary market B) increases; falls in the secondary market C) decreases; falls in the primary market D) decreases; falls in the secondary market

An example of a negative externality is:

A. the traffic created by a city hosting a popular event. B. smell of a pizza shop making pizza. C. people getting flu shots during flu season. D. All of these are examples of negative externalities.

Assume that the central bank increases the reserve requirement. If the nation has highly mobile international capital markets and a flexible exchange rate system, what happens to the quantity of real loanable funds per time period and net nonreserve-related international borrowing/lending in the context of the Three-Sector-Model?

a. The quantity of real loanable funds per time period rises, and net nonreserve-related international borrowing/lending becomes more negative (or less positive). b. The quantity of real loanable funds per time period falls, and net nonreserve-related international borrowing/lending becomes more negative (or less positive). c. There is not enough information to determine what happens to these two macroeconomic variables. d. The quantity of real loanable funds per time period and net nonreserve-related international borrowing/lending remain the same. e. The quantity of real loanable funds per time period falls, and net nonreserve-related international borrowing/lending becomes more positive (or less negative).

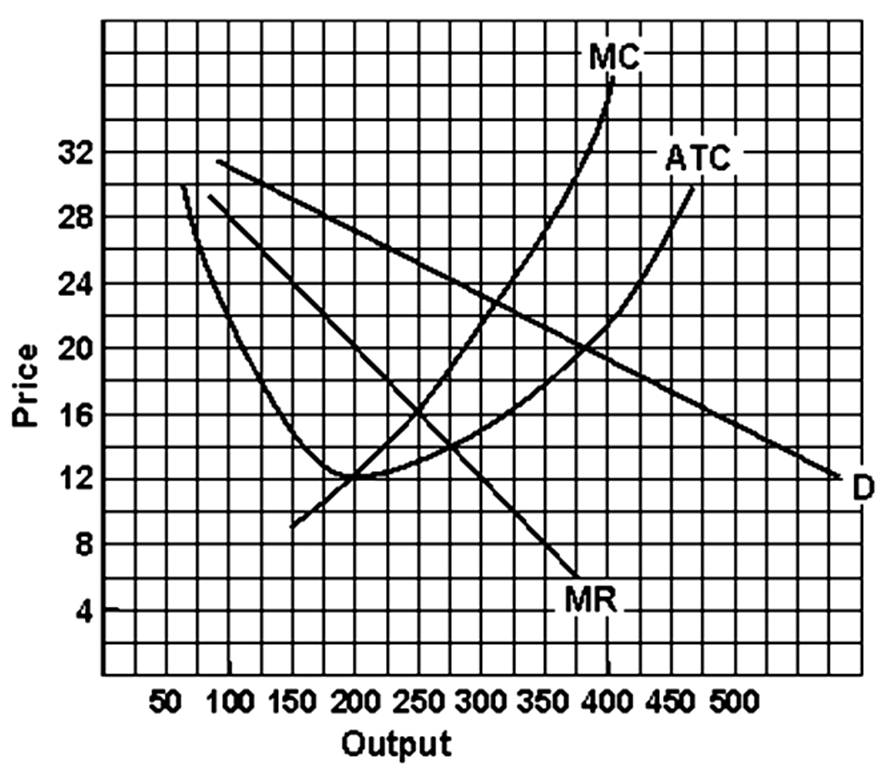

If this firm produces at its most efficient output level it would produce at about _____ units.

A. 150

B. 200

C. 250

D. 300